All Categories

Featured

Table of Contents

The rate is established by the insurer and can be anywhere from 25% to greater than 100%. (The insurance company can also alter the participate price over the life time of the policy.) For instance, if the gain is 6%, the involvement price is 50%, and the present cash money value overall is $10,000, $300 is added to the cash money value (6% x 50% x $10,000 = $300).

There are a variety of pros and cons to take into consideration prior to buying an IUL policy.: As with conventional global life insurance coverage, the insurance policy holder can enhance their premiums or lower them in times of hardship.: Quantities credited to the cash worth grow tax-deferred. The money worth can pay the insurance policy costs, permitting the insurance policy holder to lower or stop making out-of-pocket costs settlements.

Several IUL policies have a later maturation day than various other sorts of global life plans, with some ending when the insured reaches age 121 or even more. If the insured is still alive at that time, policies pay out the death benefit (however not generally the cash money value) and the earnings may be taxable.

: Smaller sized policy face worths do not use much advantage over normal UL insurance policy policies.: If the index goes down, no interest is credited to the cash value.

With IUL, the objective is to benefit from higher motions in the index.: Since the insurance firm only gets choices in an index, you're not directly spent in stocks, so you don't benefit when firms pay dividends to shareholders.: Insurers cost costs for handling your money, which can drain cash money value.

Index Life Insurance Pros And Cons

For most people, no, IUL isn't better than a 401(k) in regards to saving for retirement. A lot of IULs are best for high-net-worth people trying to find ways to decrease their gross income or those that have actually maxed out their various other retired life options. For everyone else, a 401(k) is a better financial investment car because it does not lug the high costs and costs of an IUL, plus there is no cap on the quantity you may earn (unlike with an IUL plan).

While you may not lose any cash in the account if the index drops, you won't make interest. If the marketplace transforms favorable, the incomes on your IUL will not be as high as a typical investment account. The high expense of costs and costs makes IULs pricey and substantially much less inexpensive than term life.

Indexed universal life (IUL) insurance policy offers cash worth plus a fatality benefit. The cash in the cash money worth account can gain interest with tracking an equity index, and with some commonly assigned to a fixed-rate account. Indexed universal life policies cap how much cash you can accumulate (frequently at less than 100%) and they are based on a possibly unstable equity index.

Eiul Policy

A 401(k) is a far better choice for that function since it does not bring the high fees and premiums of an IUL policy, plus there is no cap on the amount you may earn when spent. Many IUL plans are best for high-net-worth individuals seeking to reduce their taxed earnings. Investopedia does not supply tax, investment, or financial services and guidance.

An independent insurance broker can compare all the options and do what's best for you. When contrasting IUL quotes from various insurance provider, it can be complicated and challenging to understand which choice is best. An independent economic specialist can clarify the different functions in plain English and advise the best choice for your unique situation.

Variable Universal Life Insurance Calculator

Instead of looking into all the different options, calling insurance companies, and requesting quotes, they do all the job for you. Lots of insurance agents are able to save their customers cash because they recognize all the ins and outs of Indexed Universal Life plans.

It's a respectable organization that was developed in 1857 HQ lies in Milwaukee, serving for years in monetary services One of the largest insurance provider, with around 7.5% of the marketplace share Has actually been serving its insurance holders for over 150 years. The firm supplies 2 kinds of deals that are term and permanent life plans.

For cyclists, the company also provides to complete their defense. For them, term life plans consist of persistent ailments, increased fatality advantages, and guaranteed refund options. If you want, you can add an insured term motorcyclist and a kid relying on the cyclist to cover the entire household. For a Mutual of Omaha life-indexed insurance coverage, you require to have a quote or obtain in touch with a qualified agent.

Established in 1847, the company makes lots of checklists of the top-rated life insurance policy companies. Penn Mutual uses life insurance policy policies with different benefits that match people's demands, like people's financial investment objectives, monetary markets, and spending plans. One more company that is renowned for offering index global life insurance policy policies is Nationwide. Nationwide was founded in 1925.

National Life Group Indexed Universal Life

The head office of the firm lies in Columbus, Ohio. The firm's insurance coverage's toughness is 10 to three decades, in addition to the supplied insurance coverage to age 95. Term policies of the companies can be transformed right into permanent policies for age 65 and eco-friendly. The firm's universal life insurance policy policies use tax-free survivor benefit, tax-deferred profits, and the flexibility to change your costs payments.

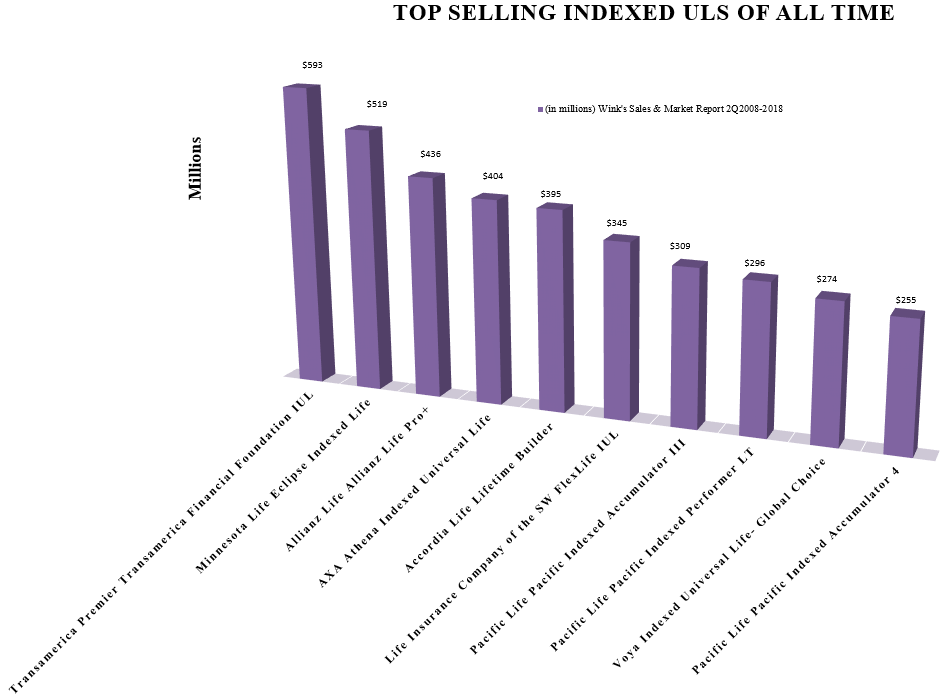

You can likewise use children's term insurance policy coverage and long-term care defense. If you are trying to find one of the top life insurance policy firms, Pacific Life is a wonderful choice. The company has actually frequently been on the top checklist of top IUL companies for numerous years in regards to selling products because the business established its really first indexed global life items.

What's good about Lincoln Financial compared to other IUL insurance policy business is that you can also transform term plans to global plans provided your age is not over 70. Principal Monetary insurer gives solutions to around 17 nations across global markets. The business provides term and global life insurance policies in all 50 states.

Variable universal life insurance can be taken into consideration for those still looking for a far better option. The money worth of an Indexed Universal Life plan can be accessed with plan financings or withdrawals. Withdrawals will minimize the survivor benefit, and loans will certainly accumulate interest, which must be paid off to maintain the plan in pressure.

Insurance Index

This policy design is for the client that requires life insurance however would like to have the ability to select how their cash worth is invested. Variable policies are financed by National Life and distributed by Equity Solutions, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Firm, One National Life Drive, Montpelier, Vermont 05604.

The info and summaries contained here are not planned to be total summaries of all terms, problems and exclusions applicable to the product or services. The precise insurance policy coverage under any type of COUNTRY Investors insurance coverage product is subject to the terms, conditions and exclusions in the actual policies as provided. Products and solutions defined in this web site vary from state to state and not all products, protections or services are offered in all states.

In case you pick not to do so, you must think about whether the product in inquiry is ideal for you. This information pamphlet is not an agreement of insurance policy. Please describe the policy contract for the specific conditions, certain information and exclusions. The plan discussed in this details brochure are safeguarded under the Policy Proprietors' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC).

For additional information on the sorts of advantages that are covered under the plan as well as the limitations of insurance coverage, where appropriate, please contact us or check out the Life Insurance policy Organization, Singapore or SDIC web sites () or (www.sdic.org.sg). This ad has actually not been reviewed by the Monetary Authority of Singapore.

Table of Contents

Latest Posts

Guaranteed Universal Life Insurance For Seniors

Best Iul Companies

Iul L

More

Latest Posts

Guaranteed Universal Life Insurance For Seniors

Best Iul Companies

Iul L